Armed Forces Exemption

A veteran who is disabled as a result of military service, the unmarried widowed spouse or orphaned minor children of a disabled veteran, or of a veteran who dies as a result of military service may be entitled to a reduction of their real property taxes.

Effective January 1, 2005, the property tax exemption for disabled veterans has been enhanced and expanded. The new law increases the disabled veteran's property tax exemption from $82,500 to $200,000 or percent thereof, of taxable value beginning in 2005; for each year thereafter, $200,000 plus an amount calculated by multiplying the amount of the limitation for the previous year by the actual percent change in the Consumer Price Index during the previous calendar year. The 2025 taxable value for exemption is $521,620. Also, it limits the property that is eligible for the exemption to the claimant's primary residence with up to 1 acre of land, and/or tangible personal property that is held exclusively for personal use and is not used in a trade or business. No exemption is allowed for any disability below 10 percent.

According to the tax commission, this means that you will not be able to exempt any property over the one acre allowed for your primary residence.

The Veteran's disability must be service-connected and proof of the disability from the Veteran's Administration is required.

Active or Reserve Member

An Active or Reserve Member of the Armed Forces may be eligible if they have served outside the state of Utah for 200 days in a calendar year or for 200 consecutive days beginning in a prior year.

Only the Primary residence is eligible for this exemption.

The claimant must reside in the county and be the owner of record on January 1 of the application year. (NOTE: Qualifying service begins on January 1, 2024, with the first application being September 1, 2025.

On or before September 1 of the year after the year of qualifying service applicant must complete an application and provide military documentation including orders for qualifying active duty service.

Applicants must apply each year they are eligible and one exemption only will be allowed in the year the member files.

The tax credit amount is equal to the total taxable value of the primary residence.

2025 Circuit Breaker/Tax Abatement Amounts

| LOW | HIGH | CREDIT |

|---|---|---|

| - | $14,490 | $1,312 |

| $14,491 | $19,324 | $1,151 |

| $19,325 | $24,152 | $993 |

| $24,153 | $28,983 | $756 |

| $28,984 | $33,816 | $600 |

| $33,817 | $38,360 | $364 |

| $38,361 | $42,623 | $204 |

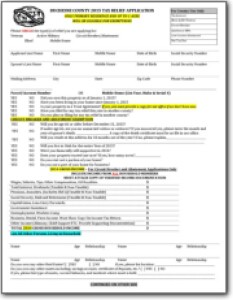

CHECKLIST- DEADLINE IS SEPTEMBER 1ST

Tax Exemptions:

IF YOU OWE BACK TAXES, this will not keep you from receiving the abatement on the current year's taxes.

2. You must OWN AND RESIDE at the primary residence/property you want the exemption applied to and at least live in it for 10 months of the year. If the property is in a trust, you must be a trustee of the trust. The abatement will only cover your primary home and up to ONE (1) acre of ground.

3. You must provide proof of your Household income which means all income received by all members of a claimant’s household in the calendar year preceding the calendar year in which property taxes are due but does not include income received by a member of a claimant’s household who is under the age of 18 or is a parent or grandparent through blood, marriage, or adoption of the claimant or the claimant’s spouse. please provide income from ALL SOURCES (everyone who lives in the home which could include but not limited to spouse/partner and children/grandchildren) with your application. (previous year's income tax, OR 3 months of bank statements OR check stubs, OR a copy of the paperwork you receive each year from your social security benefits)

4. Proof of disability must be on file in our office for Veteran or Blind Exemptions.

5. Active Military exemption persons must provide a duty roster.

6. You must sign and date the application.

7. You must apply before September 1st of each year or you may not be eligible for the abatement on your taxes.